For many fund managers, running operations with a small team can feel like a constant uphill climb. Reporting deadlines arrive faster than the last cycle closes, investor requests keep building, and every new transaction adds more reconciliation, compliance checks, and documentation.

Especially when the team is already stretched thin, you may experience increasing pressure. The industry reflects the same strain. 46% of investment firms cite outdated processes as a primary cause of reporting delays and operational inefficiencies

When growth is the goal, but bandwidth is limited, scaling operations with small teams can feel out of reach. Yet the proper structure can change the experience.

This article explains why lean teams struggle and how technology becomes a meaningful force multiplier in portfolio management.

The Core Problem: Complexity Outpaces Capacity

Lean fund teams now operate in a space where operational requirements are multiplying faster than their internal capacity can bear. Here’s how the core problem spirals:

Operational complexity keeps increasing

Modern funds manage diverse portfolios, including a blend of private funds, public markets, fixed income, and alternative assets. Each class has its valuation rules, compliance checks, and reporting cycles, creating a higher volume of operational load for small teams.

Additionally, regulators have increased oversight. In 2023 and 2024, the SEC introduced extra rules around private fund audits, fee transparency, quarterly statements, and investor disclosures. These demands raise the management load on internal teams, particularly those without dedicated tools and compliance staff.

Manual workflows cannot keep pace

Despite the increasing pressure, 90% of firms still depend on spreadsheets and manual data reconciliation. Manual processes slow down cycle times and raise the chances of inconsistent reporting. This issue compounds for small teams, where a single reporting cycle can absorb an excessive amount of staff time.

Investor expectations push volume even higher

Limited partners anticipate swift updates with clearer fund visibility. Beyond procedural performance reporting, fund administrators must prepare capital call notices, regulatory statements, and provisional investor responses.

As the investor base widens, every repetitive task multiplies. This strains the resources for lean teams and raises the chances of inconsistencies or delays. This is why over two-thirds of fund administrators prioritize digitization drives to lessen operational strain.

Why Technology Becomes a Force Multiplier

By nature, fund operations create repetitive, time-sensitive, and workflow-focused tasks. Here’s how technology allows small teams to handle extra assets, investors, and transactions:

Streamlining volume-heavy operational work

Repetitive tasks follow predictable pathways, making them suitable candidates for structured workflows and automation. Redwood’s 2025 index report shows that 73% of enterprises have increased automation spend and reduced costs by at least 25%. Additionally, a recent study highlights that digitization improves service time by 20% and increases customer numbers by 15%.

As automation moves recurrent tasks to structured frameworks instead of spreadsheets, lean teams recover time for analytical and investor-focused tasks.

Speeding up internal workflows and the approval cycle

Deal fulfilment, valuations, capital calls, and investor reporting all rely on prompt authorizations. Delays may occur due to scattered information across various systems, documents, or emails.

When small teams adopt technology, they fast-track internal cycles. This shrinks the lag between data collection, decision processing, and investor communications. As a result, the team’s momentum remains stable even as transaction volume grows.

Driving accuracy and consistency at scale

Manual reporting and reconciliation are susceptible to irregular data, errors, and duplicate work. This negatively impacts valuation precision, investor experience, and compliance reporting.

Digitization rectifies these errors by using standardized data inputs, employing consistent computation logic, and having controlled document versions. According to a Gartner survey, digitization with high technology reduces financial errors by 75%. This is because data flows through a consistent framework instead of multiple manual touchpoints.

What Makes a Scalable Ops Tech Layer Effective

Technology only becomes effective for fund lean teams when it drives order, eradicates frictions, and augments consistent implementation. Here are the core traits of a scalable Ops tech:

Unified workspace

Fragmented fund data makes reporting and reconciliation a nightmare. A scalable operational layer consolidates key data into a unified environment, reducing risk. This ensures:

- ・Harmonious data

- ・Simpler audits

- ・Quick reporting cycles

- ・Fewer versioning issues

Structured workflows

Regulatory demand, internal oversight, and investor reporting all adhere to stringent procedures. Failure to standardize these workflows raises the likelihood of more errors and inconsistent outcomes. Scalable tech embeds operational structure right into teams’ daily activities by:

- ・Outlining review and authorization steps

- ・Ensuring compliance checkpoints are strictly followed

- ・Monitoring deadlines and reporting cycles

- ・Having consistent documentation

These elements safeguard the fund from operational oversights and help small teams preserve regulatory discipline even as reporting complexity rises.

Real-time visibility

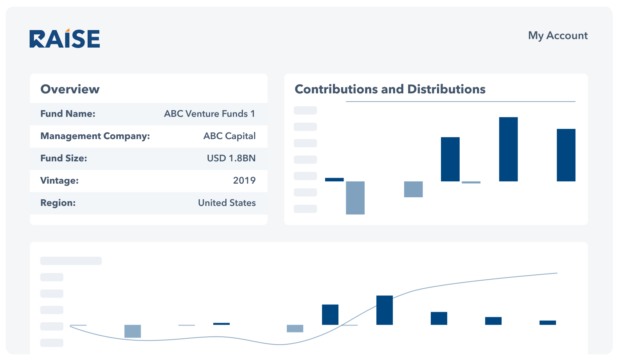

When small teams lack visibility, they struggle to spot delays, lags, or missing data. A scalable operations tech system, such as RAISE, provides dashboards and holistic status views that display:

- ・Compliance actions

- ・Approval queues

- ・Deal progress

- ・Reporting schedule

- ・Pending tasks

With complete visibility, fund managers can address issues and ensure workload is even across the team. This boosts small team operational efficiency in fund management.

Intelligent support

Whereas lean teams must be deeply involved in crucial decision-making, support features can refine recurrent work. Effective operational systems offer:

- ・Standardized document generation

- ・Built-in template for investor communication

- ・Automated computations for performance, NAV, and allocation metrics

- ・Automated reminders and notices

RAISE offers these capabilities with personalized fund management, ensuring repetitive output follows a standardized format.

Flexible automations

Scalable technology is not rigid. As fund operations grow, the technology’s operational layer should adapt without demanding extra headcount. Flexible workflow automation for funds encompasses:

- ・Flexible triggers and rules

- ・Customizable workflows

- ・Support for various asset classes

- ・Adaptable attributes that expand as needs shift

This configuration allows small teams to preserve consistency even as their operational needs rise.

How RAISE Enables Lean Teams to Scale Smarter

Lean teams need a solid framework that brings visibility, precision, and operational structure into each stage of the fund lifecycle.

RAISE provides this infrastructure by consolidating data, unifying processes, and automating the recurrent tasks that restrict capacity. Small teams get a system that allows them to operate consistently with the output of much larger firms.

Here’s how RAISE supports these elements:

- ・Automated capital activity: Automates capital calls, distribution notices, and contribution monitoring, lessening the management workload that usually consumes month-end bandwidth.

- ・Solves fragmented data: All funds and portfolio data, risk profile, performance metrics, and historical records are centralized into one interface.

- ・Strengthens compliance execution: Embed compliance phases into processes, ensuring approval, documentation, and records are built as work progresses.

- ・Supports scale without additional staff: As funds grow, RAISE automatically adapts through flexible workflows and cloud-based scalability.

- ・Reduces reporting cycle: Its automated reporting pulls from structured data and built-in templates, helping lean teams promptly complete reports.

Process automation in fund management positions RAISE as a dependable partner for lean teams. Request a demo today to experience its impact in practice.

Quick Playbook: How Small Teams Can Start Scaling Today

Small teams can augment their operational capacity through focused action. This immediately lowers the pressure, improving operational throughput in funds. Here are the optimal steps to follow:

・Examine where manual work delays progress: Spot activities that often cause delays and document where the team loses more time.

・Turn repetitive tasks into smooth workflows: Optimize steps, approvals, and documentations for procedures, such as deal origination, monthly reporting, and compliance evaluations, to eliminate skepticism and prevent rework.

・Automate expected sequences: Automate activities that follow clear trends, including repetitive notices, data centralization, and deadline reminders. This ensures fewer hours are spent on managerial work.

・Centralize operational data: Consolidate approvals, reporting, and documentations into a unified system to eradicate siloed files and lower the back and forth of finding precise data.

・Monitor operational gains: Track improvements in turnaround time, error reduction, task fulfilment rates, and reporting consistency to identify where capacity has broadened and where to optimize efficiency next.

Where Lean Ops Wins From Here

As funds continue scaling operations with small teams, the advantage is felt by those with structured workflows and centralized systems.

These support small teams in managing extra investors, reporting cycles, and complex portfolios without adding staff. As a result, consistency improves, operational reliability becomes stronger, creating a premise for sustainable growth.