In portfolio management, investors expect clarity, precision, and speed. Fund managers are expected to provide both insight and results and are under constant pressure to do so.

Analytics and reporting enable informed decision-making and execution from complex and multi-sourced data. Particularly, asset managers who embrace advanced analytics and AI can reduce operational costs by 40%, freeing teams from manual processes to focus more on strategic portfolio management.

From detecting emerging risks to providing transparent and insightful reports to investors, analytics and reporting are the differentiators between firms that proactively manage and those that are a step ahead in the market.

In this guide, we examine how analytics and reporting in portfolio management are shifting fund accounting and reporting workflows, driving efficiency, and enabling better, faster, and strategic decisions for fund managers.

Analytics as a Driver of Efficiency

Portfolio monitoring efficiency encompasses foresight, speed, and scalability. Advanced analytics have shifted how fund managers track performance, evaluate risk, and make allocation decisions. Rather than depending on cyclical, backward-focused reports, teams can now gain real-time reporting insights that drive quick and informed decision-making.

According to McKinsey, fund management firms that capitalize on advanced analytics see stronger investment performance, faster decision-making, and higher profitability. These gains come from using data-driven insights to reduce bias, uncover hidden patterns, and enhance both portfolio and client outcomes.

Beyond efficiency, analytics changes how investment administrators identify opportunities and mitigate risk. Predictive models can now comprehend thousands of variables and simulate potential scenarios across different markets to aid in allocating investment portfolios. These provide insight into future client needs, allowing managers to adjust portfolios in advance and increase alpha generation.

Additionally, asset managers can apply forensic analytics to boost risk identification and reduce time spent on trade monitoring activities by 55-80%. They can also identify inconsistencies and compliance reporting issues before they become expensive missteps.

Even so, analytics in portfolio management are only powerful if well implemented. Some firms still rely on data silos, inconsistent quality, and legacy frameworks that limit their analysis scope. However, firms have unique metrics and investment philosophies, requiring customizable and flexible analytics solutions.

As Linovate Partners, we believe in empowering clients to be real users of their data, not just preparers of it. Our analytics solutions are tailored to put intelligence directly into the hands of portfolio managers. It enables them to survey insights, visualize trends, and make data-backed decisions with integrity and accuracy.

Reporting as a Catalyst for Transparency and Speed

Strong analytics and timely, precise, and accessible reporting convert insights into speed, confidence, and regulatory compliance. It also improves the efficiency of primary processes within asset management. In a McKinsey case study, a firm utilized NLP to retrieve over four million distinct data elements, which yielded a 60% reduction in report generation time.

Still, timely and precise reports boost communication between investors and fund managers, reducing queries and the likelihood of misunderstanding. As a result, teams spend less time regularizing data and more time implementing analytical insights that promote strategic decisions.

With digital dashboards, investors can view their portfolio performance data in real-time, reducing the time to report on performance by 85% and reporting discrepancies by 92%. Portfolio administrators, investors, and compliance officers can then readily view performance indicators, explore changes over time, and assess key indicators without relying on static reports.

Transparency as an Efficiency Multiplier

Transparency in fund operations is a fundamental driver of operational efficiency in fund administration. Transparent, harmonious data ensures that administrators, investors, and regulators work from a unified data repository, thereby minimizing miscommunications, contentions, and expensive rework. With uniform alignment on numbers and similar versions of the truth, workflows move smoothly.

A key hurdle in asset management efficiency is the extended onboarding process. According to an Ernst and Young survey, 79% of asset managers highlight that it takes one to three months to onboard institutional clients. Shockingly, only 7% complete the process within one month. This delay can cost opportunities and ruin client relationships.

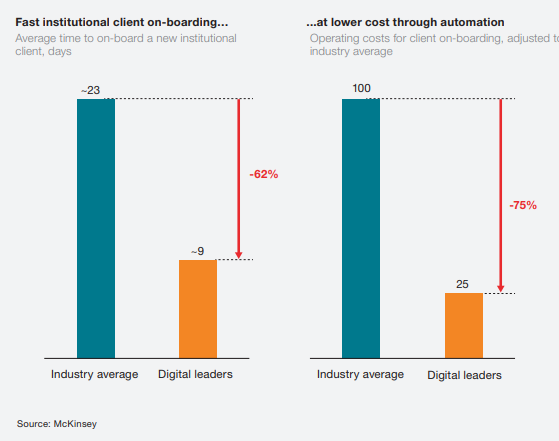

Thankfully, analytics tools help asset managers to optimize onboarding processes to swift cycle times and lower costs. Those who capitalize on these tools reduce client onboarding by 62% and costs by 75% compared to the industry average.

Therefore, redesigning the onboarding journey means that new accounts are promptly funded, accelerating revenue recognition.

With partners like Linnovate Partners, you can customize analytics solutions to your workflow and investor needs. The reward? You convert transparency and accuracy into an enabler of trust, efficiency, and scale.

The Future of Analytics in Portfolio Management

With 93% of asset managers planning to use data analytics and insight in every business area, analytics is no longer a back-office function. It is a powerful engine that steers prompt, smarter, and better portfolio management decisions.

Looking into the future:

AI and predictive analytics drive strategic insights

Generative AI is shifting insight generation and decision-making in investment administration. McKinsey’s calculations estimate an 8% increase in efficiency. Analysts are increasingly utilizing gen-AI to harmonize data from financial reports, earnings calls, and conferences, thereby boosting the insight generation process.

Advanced risk models and automated reporting offer additional support for a more data-driven investment strategy. As operational workflows become increasingly automated, the reliance on manual checks is expected to decline.

Platform standardization and interoperability

Modern fund management platforms, such as RAISE, allow the smooth flow of data, minimizing errors and duplication. Standardization procedures unify reporting, accounting, and risk management, ensuring that all use reliable data. Such seamless interoperability sustains scalability, allowing firms to manage larger portfolios or different fund frameworks without a corresponding increase in staff.

From processors to strategic advisors

With precise and timely updates, portfolio administrators and managers can take on strategic advisory roles. Instead of following routine processes, they can shift to client advisory services, optimize portfolios, and make value-driven decisions.

The Strategic Value of Analytics and Reporting

Analytics and reporting in portfolio management strategically propel portfolio transparency, efficiency, and trust. Advanced artificial intelligence tools and workflows help firms convert increasingly compounded, fragmented datasets into decision-making insights. This way, portfolio managers can make timely, smarter decisions and reduce errors and manual effort.

Flexible and customized solutions push teams to maximize their data, establishing a seamless pathway from raw data to strategic decisions. The use of appropriate reporting, dynamic dashboards, and predictive analytics enables firms to improve portfolio performance and strengthen client engagements while confidently scaling operations.